HR & Compliance

Take the guesswork out of HR and Compliance

Get the tools you need to easily handle even the most complex HR and Compliance challenges. From on-demand certified HR professionals to a robust compliance library and employee training courses, we’ve got you covered.

Certified HR Experts

Access Certified HR Professionals anytime

Our platform offers the unique advantage of on-demand access to certified HR professionals. Need expert advice on complex HR issues? Our team is just a click away, ready to assist you in navigating the intricacies of HR management.

- Get immediate answers to HR questions

- Receive guidance on employee relations and compliance matters

- Ensure your HR decisions are informed and legally sound

Compliance Resources

Extensive HR Compliance Library at your fingertips

Our HR compliance library is your comprehensive resource for staying up-to-date with ever-changing regulations. Access a wealth of documents, policies, and guidelines. For immediate assistance, help is just a message away with our live-chat HR Concierge.

- Simplify compliance management with a centralized hub

- Instantly find answers to complex HR compliance questions

- Navigate regulations confidently with live-chat support

Employee Handbooks

Craft Employee Handbooks with ease

Building a robust employee handbook is a breeze with our intuitive tools. Customize policies to align with your company’s values and industry standards. Ensure clarity and consistency in communicating expectations to your workforce.

- Tailor employee handbooks to your unique company culture

- Promote transparency and fairness among employees

- Save time and effort with user-friendly handbook creation

Tackle HR and compliance like a pro

From expert guidance to comprehensive resources, we provide the tools you need to thrive in the world of HR and compliance.

ACA Compliance Reporting

Streamline ACA Compliance Reporting

Simplify the complexities of Affordable Care Act (ACA) compliance reporting. Our feature offers automated tracking, reporting, and alerts, ensuring your organization remains compliant with healthcare regulations. Say goodbye to manual calculations and reduce audit risks.

- Avoid penalties by staying ACA compliant effortlessly

- Automate data collection and reporting processes

- Enjoy peace of mind knowing your ACA obligations are met

Employee HR Training

Empower employees with compliance training

Elevate your workforce’s knowledge and skills with our employee HR and compliance training courses. From Workplace Harassment Prevention (WHP) to safety protocols, we offer a wide range of courses designed to foster a culture of compliance and growth.

- Enhance employee engagement and compliance awareness

- Provide employees with the tools to excel in their roles

- Strengthen your organization's commitment to employee development

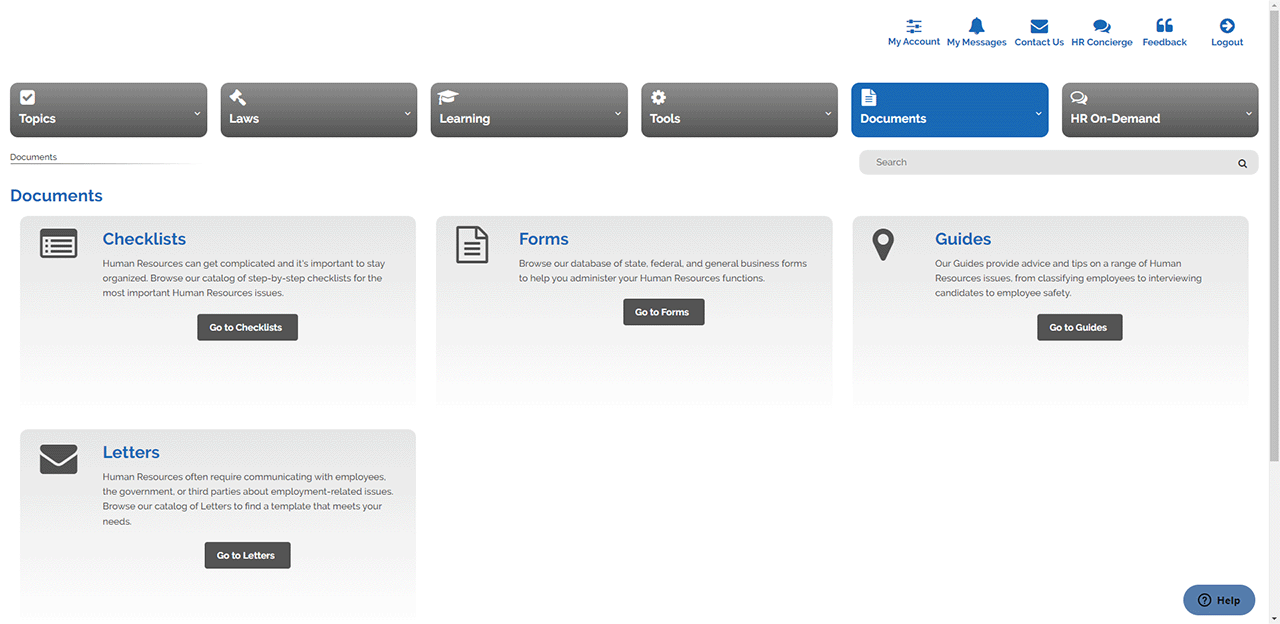

HR Document Library

Effortless HR Document creation

Create professional HR documents in minutes using our template library. From offer letters to performance reviews, our pre-designed templates cover all your HR needs. Customize them to align with your company’s specific requirements effortlessly.

- Expedite HR paperwork with ready-to-use templates

- Ensure consistency and professionalism in documentation

- Save valuable time and reduce administrative burdens

Everything you need to support your business

Explore all of our services to find everything you need for your business.

FREQUENTLY ASKED QUESTIONS

What questions do you have?

Review answers to our most commonly asked questions or contact us for more details.

What is HR compliance?

HR compliance refers to adhering to laws, regulations, and policies related to human resources in the workplace. It ensures fair treatment of employees and minimizes legal risks.

Why is HR compliance important for businesses?

HR compliance is crucial as it helps companies avoid legal troubles, create a fair work environment, and build trust with employees, ultimately leading to business success.

What services do certified HR professionals provide?

Certified HR professionals offer guidance on hiring, firing, benefits, training, and policy development, helping businesses navigate HR challenges effectively.

How can I access HR compliance resources online?

Our platform provides an online HR compliance library, offering access to documents, templates, and expert guidance for all your compliance needs.

What is ACA compliance reporting, and who needs it?

ACA compliance reporting is essential for employers subject to the Affordable Care Act. It involves tracking and reporting employee health coverage to remain compliant with the law.

How can I create employee handbooks easily?

Our user-friendly tools and templates make crafting employee handbooks a breeze. Customize policies and content to suit your company’s needs effortlessly.

How do HR document templates save time?

HR document templates are pre-designed forms and documents that can be easily customized. They save time by eliminating the need to create documents from scratch.

Is compliance training necessary for employees?

Yes, compliance training is crucial to ensure employees understand and follow company policies and legal requirements, reducing the risk of violations.